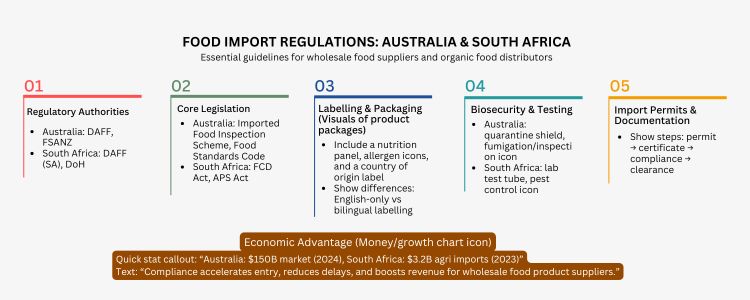

How to Export Food to Australia and South Africa: Compliance Roadmap

A mid-sized wholesale food supplier intending to export organic vegetables and packaged food recently found out that non-compliance may halt sales and undermine the margins. As the Australian food and grocery market is estimated to be worth USD 150 billion in 2024, and grows steadily, and as South Africa imports about USD 3.2 billion of consumer-orientated agricultural products in 2023, the business case is obvious, and so are the regulatory challenges.

Why is Compliance Important?

Compliance with import regulations is not only a legal requirement but also a business benefit. Subjecting to compliance reduces the border clearance times, reduces the cost of detention, and enhances relationships with the major purchasers, such as national supermarket chains and distributors of food products in wholesale.

In the case of wholesale organic food distributors and organic vegetable suppliers, clear certification and proper labelling earn them high shelf placement and a premium margin contract in both Australia and South Africa.

The recent market research indicates an increased consumer demand regarding organic and traceable foods that leads to a higher price and accelerated category development. China ranks among the most rapidly growing economies globally, necessitating the establishment of joint ventures (JVs) to capitalise on market opportunities. China is one of the fastest expanding economies in the world, and it requires the establishment of joint ventures (JVs) to take advantage of the respective opportunities in the market.

Australia's Key Regulatory Pillars

- The leaders are the Department of agriculture, fisheries and forestry (DAFF) and the Food Standards.

- Biosecurity and Quarantine: Extremely strict; all imports are evaluated to avoid pests and disease and might need certain treatment or verification.

- Food Standards Code: Regulates composition, contaminants, additives and allergen declarations; compliance is a mandatory requirement of packaged food that is offered through wholesale channels.

- Labelling & Documentation: Country of origin, nutrition panel, ingredient listing and allergen statements are mandatory; import permits and health certificates are frequently mandatory.

South Africa – Significant Regulatory Pillars

- Lead Authorities: Department of Agriculture, Forestry and Fisheries (DAFF – South Africa) and Department of Health with respect to food safety.

- Codifying Laws: The Foodstuffs, Cosmetics and Disinfectants Act regulates the labelling and safety; the Agricultural Product Standards Act grades produce.

- Testing & Permits: Microbiology testing and compliance documentation are usually needed; import permits are usually needed on many agri products.

Quick Comparison Table

| Regulation Area | Australia | South Africa |

| Lead Authorities | Jurisdiction of quarantine and biosecurity is under the Department of Agriculture, Fisheries and Forestry (DAFF). Food composition, additives, allergens and labelling are regulated by Food Standards Australia New Zealand (FSANZ). |

Agricultural imports and quality are handled by the Department of Agriculture, Forestry and Fisheries (DAFF – South Africa). The Department of Health (DoH) secures food safety and hygiene. |

| Core Legislation | Imported Food Inspection Scheme (IFIS): The inspection and testing of the high-risk foods (e.g., seafood, dairy, meat, nuts) should be conducted. Australia New Zealand Food Standards Code: Regulates ingredients, additives, contaminants, allergens and nutrition information. |

Foodstuffs, Cosmetics & Disinfectants Act (FCD Act): This act regulates food safety, preservatives and additives. Agricultural Product Standards Act (APS Act): Establishes standards of grading of fresh produce, wine, and dairy. Meat Safety Act: Provides the inspection of meat and meat products. |

| Biosecurity & Quarantine | Extremely strict. Dedicated to the avoiding of pests, diseases and contamination. Possibly dangerous products are usually subject to treatment certificates (fumigation, irradiation, or heat treatment). Goods not behaving are destroyed or re-exported. | Tough on animal and plant imports. Veterinary or phytosanitary certificates are needed on fresh produce, meat, and dairy. Pesticide residues, microbiological safety and compliance testing are widespread. |

| Labelling & Packaging | Compulsory Country of Origin Labelling (CoOL) Nutrition Information Panel (NIP) of standard format. Allergens should be stated very clearly (peanuts, gluten, milk, etc.). Date marking: ‘Use by’ or ‘Best before’ should be used. English is required on labels. |

Should have the product name, an ingredient list (in decreasing order), a nutritional panel and allergen statements. Shelf life or expiry dates are required. Guidelines used by the South African The Department of Health dictates that labelling should be bilingual (English and one official language). Fake assertions (e.g., organic uncertified) are not allowed. |

| Certification & Documentation | – Import Permit from DAFF (required for many high-risk foods). – Health Certificate from the exporting country’s competent authority. – Treatment Certificates (if applicable). – Organic certification must be recognised under Australian equivalence standards. |

– Import Permit from DAFF (SA). – Veterinary or Phytosanitary Certificates for plant and animal products. – Certificates of Analysis (for microbiological or chemical testing). – Organic certification must align with SA National Organic Standards. |

Commonly Faced Challenges.

The most common causes of delays include documentation errors, inconsistent labelling (particularly of allergens), and absence of pre-shipment tests. Wholesale food suppliers and wholesale organic food distributors need to be informed that there should be harmonised ingredient lists and certified organic statements because it will be rejected at the border.

Checklist Of Actionable Compliance

- Prepare product spec.

- Get pre-shipment laboratory tests and health certificates.

- Take out import permissions.

- Utilise certified labelling templates.

- Hire a licensed customs broker.

- Arrange third-party audits.

This basic flow minimises risk to detention and aids in prompt approval by supermarkets and wholesale purchasers.

Future Outlook

This will put greater demand on digital traceability (QR codes, blockchain proofs) and sustainability credentials, which will be required by regulatory regimes. The growing organic business provides a bigger margin to wholesale organic food distributors and organic vegetable suppliers, but only those exporters who integrate compliance as a part of their supply chain policy.

Economic forecasts show that in Australia, there is a stable growth of organics and the grocery retail market; in South Africa, the demand for imports is strong, which supports the argument of the economy to comply. A physician can use this information to evaluate the personal costs and benefits of the trial prior to starting it.

Conclusion

Export potential is translated into sales as a result of regulatory preparedness. Wholesale food suppliers looking to access Australia and South Africa must now focus on biosecurity, labelling and certified testing to access the increasing wholesale food products demand and organic offerings.

Inductus Global has an export compliance team that can be consulted on creating a compliance roadmap that fits your SKU mix to ensure faster entry and profitable market penetration.

Frequently Asked Questions (FAQ)

Electronics, pharmaceuticals, renewable energy, and textiles will all be drivers.

India provides cost-effectiveness, skilled labor, and positive policy choices, making India a secure addition to global supply chains.

Textiles, pharmaceuticals, agro-processed products, and electronics.

Very competitive due to regulatory compliance, quality, and cost parity with similar products, and benefits from a tariff-free trade agreement.

Suppliers provide flexibility, scale, and reliability to global buyers and thus mitigate the supply chain disruption inherent in supply chain risks.

Great people, great policy, together with a variety of industry clusters.